Planning Of Banking Insurance

In today’s dynamic world, financial security is paramount. It allows us to navigate life’s uncertainties with greater peace of mind, plan for the future, and protect what matters most. This guide delves into the crucial aspects of banking and insurance planning, equipping you with the knowledge to make informed decisions and build a solid financial foundation.

Part 1: The Banking Landscape – Your Financial Hub

Understanding Banking Products

- Checking Accounts: The cornerstone of everyday banking, checking accounts offer convenient access to your funds for regular transactions through debit cards, checks, and online banking.

- Savings Accounts: Designed for accumulating funds, savings accounts provide a safe haven for your money and often accrue interest, encouraging saving habits.

- Money Market Accounts: Offering a higher interest rate than traditional savings accounts, money market accounts may have limitations on withdrawals but provide a good balance between liquidity and returns.

- Certificates of Deposit (CDs): CDs lock your money in for a predetermined period in exchange for a guaranteed interest rate, ideal for saving for specific goals.

- Investment Accounts: These accounts allow you to invest in stocks, bonds, mutual funds, and other assets, potentially generating higher returns but carrying greater risk.

Choosing the Right Bank

- Consider Fees: Analyze monthly maintenance fees, ATM withdrawal fees, and minimum balance requirements.

- Interest Rates: Compare interest rates offered on checking, savings, and money market accounts to maximize your returns.

- Location and Accessibility: Choose a bank with convenient branch locations or a user-friendly online banking platform.

- Customer Service: Prioritize banks with a reputation for excellent customer service to ensure prompt assistance when needed.

- Financial Products Offered: Select a bank that aligns with your financial needs. Do you need access to investment products, mortgage services, or safe deposit boxes?

Smart Banking Practices

- Budgeting and Tracking: Develop a budget to track income and expenses, ensuring you don’t overspend. Utilize online banking tools or budgeting apps to stay organized.

- Emergency Fund: Prioritize building an emergency fund of 3-6 months’ living expenses to weather unexpected financial hardships.

- Utilize Automatic Transfers: Automate transfers to savings accounts or investment accounts to consistently build your wealth.

- Minimize Debt: Manage credit cards responsibly and prioritize paying down high-interest debt.

- Beware of Scams: Stay vigilant against phishing scams and protect your online banking credentials.

Part 2: The Power of Insurance – Safeguarding Your Future

Understanding Insurance Concepts

- Risk Management: Insurance helps transfer financial risk associated with unforeseen events to an insurance company in exchange for a premium.

- Risk Pooling: Premiums paid by a group of individuals create a pool used to compensate those who experience a covered loss.

- Indemnification: In most insurance policies, the insurance company aims to restore you to the financial position you were in before the covered event.

Types of Essential Insurance

- Life Insurance: Provides financial protection for your loved ones in the event of your death. Term life insurance offers coverage for a specific period, while whole life insurance offers a death benefit and a cash value component that grows over time.

- Health Insurance: Covers medical expenses incurred due to illness or injury. Explore options like employer-sponsored health plans, individual plans, and government programs like Medicare and Medicaid.

- Disability Insurance: Replaces a portion of your income if you become disabled and unable to work.

- Auto Insurance: Protects you financially from liabilities arising out of car accidents. Coverage typically includes liability, collision, and comprehensive.

- Homeowners Insurance/Renters Insurance: Protects your property and belongings from damage caused by fire, theft, and other covered perils. Renters insurance protects your personal belongings within a rental property.

Additional Considerations

- Property and Casualty Insurance: This category encompasses various insurance options like flood insurance, earthquake insurance, and umbrella insurance, depending on your specific needs.

- Long-Term Care Insurance: Helps cover the cost of long-term care services in the event of illness or disability requiring assistance with daily living activities.

- Business Insurance: Protects businesses from financial losses due to property damage, liability lawsuits, and employee-related issues.

Choosing the Right Insurance

- Needs Assessment: Conduct a thorough needs assessment to determine the types and amounts of insurance coverage you require.

- Compare Quotes: Obtain quotes from multiple insurance companies to compare coverage and pricing. Consider factors like deductibles, exclusions, and claim settlement reputation.

- Consult an Insurance Agent: A qualified insurance agent can guide you through the selection process, explain policy details, and suggest appropriate coverage levels.

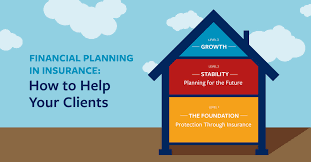

Building Your Financial Fortress – Integrating Banking and Insurance

Now that you possess a foundational understanding of banking and insurance products, let’s explore how to strategically integrate them to create a robust financial plan.

Optimizing Your Banking Strategy

- Align Banking Products with Insurance Needs: For instance, consider using a high-yield savings account to accumulate funds for deductible payments on your insurance policies.

- Leveraging Automatic Transfers: Automate monthly transfers to cover insurance premiums, ensuring timely payments and avoiding policy lapses.

- Managing Risk Tolerance: Utilize a combination of checking and savings accounts to manage your day-to-day finances while keeping emergency funds readily available. Consider investment accounts for long-term goals, but remember, a higher risk tolerance translates to potentially higher returns but also greater potential for losses.

Maximizing Your Insurance Coverage

- Life Insurance and Beneficiaries: Tailor your life insurance death benefit to meet your dependents’ needs, considering future education costs or mortgage payments. Designate clear beneficiaries to ensure a smooth claims process.

- Disability Insurance and Income Replacement: Choose a disability insurance policy that replaces a sufficient portion of your income to maintain your standard of living if you become disabled.

- Bundling Insurance Policies: Explore bundling discounts offered by some insurance companies when purchasing multiple policies like homeowners and auto insurance together.

- Reviewing and Updating Policies: Regularly review your insurance coverage as your life circumstances evolve. Adjust coverage levels as needed, such as increasing life insurance benefits after welcoming children or purchasing a new home.

Financial Planning for Life Stages

- Young Adults: Focus on building an emergency fund, establishing good credit habits, and securing basic insurance coverage like health and auto insurance.

- Mid-Career Professionals: Prioritize saving for retirement through employer-sponsored plans or IRAs, consider increasing life insurance coverage, and explore additional insurance options like long-term care.

- Nearing Retirement: Focus on transitioning retirement savings into income streams, re-evaluate insurance needs based on changing circumstances, and ensure long-term care plans are in place.

Conclusion: A Roadmap to Financial Security

By strategically integrating banking and insurance strategies, you can build a robust financial fortress that empowers you to navigate life’s uncertainties with confidence. Remember, a well-crafted plan requires ongoing monitoring and adjustments. Regularly reassess your financial situation, seek professional advice when needed, and embrace a proactive approach toward achieving your financial goals. With dedication and informed decisions, you can secure a brighter financial future for yourself and your loved ones.

Additional Tips:

- Utilize online resources and financial planning tools to create a personalized budget and explore insurance options.

- Consider consulting a financial advisor for in-depth guidance tailored to your unique needs and goals.

- Develop a positive financial mindset. Financial security is a journey, not a destination. Celebrate your achievements and stay committed to your long-term goals.

By following these steps, you can transform banking and insurance from complex concepts to powerful tools that pave the way for a secure and fulfilling financial future.

Pingback: Building a Secure Future - Loan And Insurance