Understanding and Negotiating Your Insurance Policy Premium

Understanding and Negotiating Your Insurance Policy Premium is a cornerstone of financial security. It provides a safety net in case of unexpected events, protecting you from significant financial losses. However, the cost of this protection, known as the insurance premium, can be a significant financial burden. Understanding the factors that affect your premium and strategies for negotiating it can help you achieve the right balance between coverage and affordability.

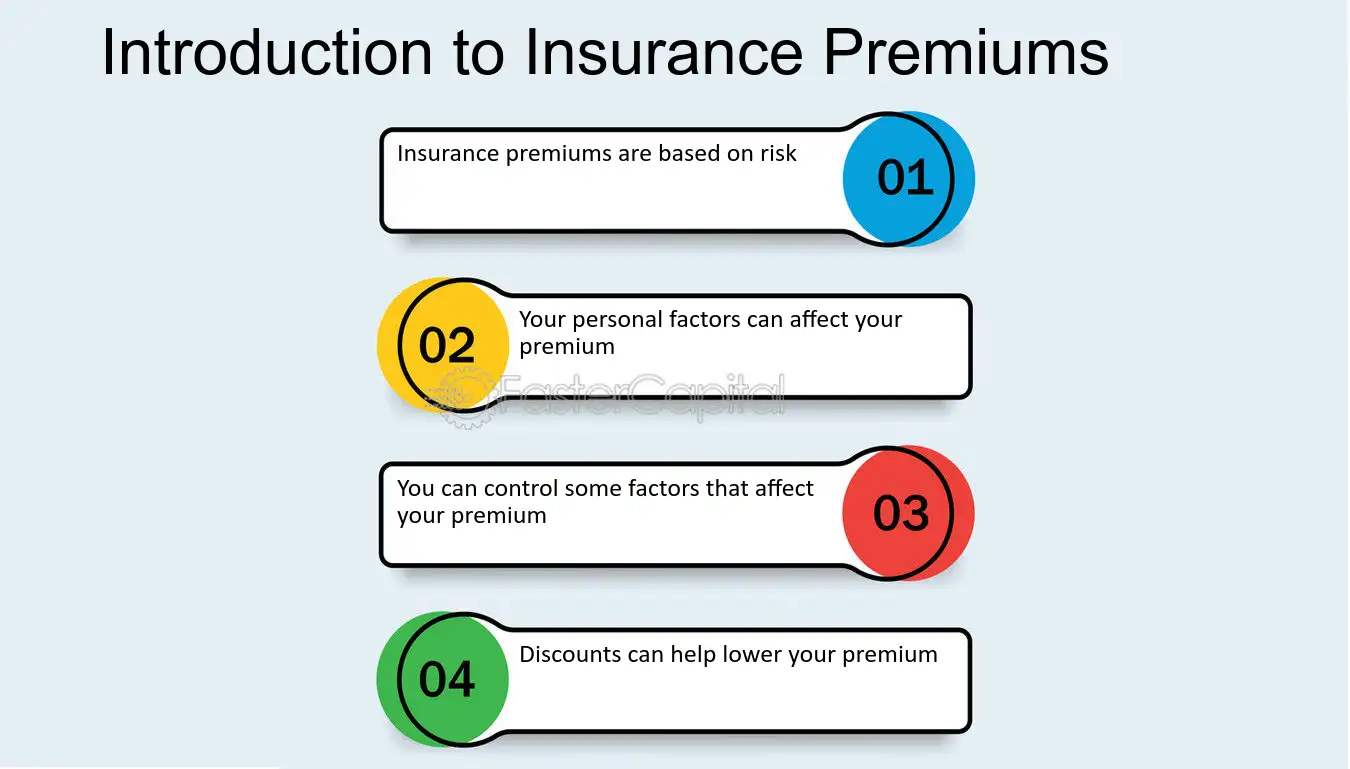

Demystifying the Insurance Premium

An insurance premium is the periodic payment you make to an insurance company in exchange for coverage. This payment goes towards a pool of funds used by the company to pay out claims to policyholders who experience covered events. The amount you pay is determined by a complex calculation that considers various factors specific to you and the type of insurance you’re seeking.

Here’s a breakdown of the key factors influencing your insurance premium:

-

Risk Profile: This refers to the likelihood that you will file a claim. Insurers assess your risk profile based on various factors. For example, in car insurance, your age, driving history, location, and type of vehicle all play a role.

-

Coverage Level: The extent of coverage you choose directly impacts the premium. Higher coverage limits and additional benefits generally lead to a higher premium.

-

Deductible: The deductible is the amount you pay out of pocket before the insurance company starts covering expenses. Choosing a higher deductible reduces your premium but raises your initial cost in the event of a claim.

-

Claims History: Past claims filed can significantly increase your premium. A clean claims history, on the other hand, can lead to discounts.

-

Other Factors: Depending on the type of insurance, additional factors like your credit score (for some insurance types), property characteristics (for home insurance), and health history (for health insurance) can also influence the premium.

Strategies for Lowering Your Insurance Premium

While insurance premiums are essential, there are ways to make them more manageable:

-

Shop Around and Compare Quotes: Don’t settle for the first offer you receive. Get quotes from multiple insurance companies to compare rates and coverage options.

-

Increase Your Deductible: Raising your deductible is a straightforward way to lower your premium. However, ensure you can comfortably afford the higher out-of-pocket cost in case of a claim.

-

Maintain a Good Record: A clean driving record, a safe home environment, and a healthy lifestyle (for health insurance) can all lead to discounts.

-

Bundle Your Policies: Many insurance companies offer discounts for bundling multiple policies, such as car and home insurance.

-

Negotiate Your Premium: Don’t be afraid to negotiate your premium with your chosen insurance company. Mention your good driving record, loyalty, or safety measures taken to lower your risk profile.

-

Review Your Coverage Regularly: As your circumstances change, revisit your coverage needs and adjust your policy accordingly. Consider dropping unnecessary add-ons or reducing coverage if your risk profile has improved.

Beyond Cost: Finding the Right Balance

While minimizing the cost is important, remember that insurance is about protecting yourself financially. Here are some additional considerations beyond just the premium:

-

Coverage Adequacy: Ensure your chosen coverage level is sufficient to meet your needs in case of a claim. Don’t prioritize a lower premium over adequate protection.

-

Financial Strength of the Insurer: Research the financial stability of the insurance company before finalizing your policy. A financially sound insurer is more likely to fulfill its obligations in the event of a claim.

-

Customer Service Reputation: Consider the customer service reputation of the insurance company. Dealing with a responsive and helpful insurer is crucial during the claims process.

Conclusion

Understanding your insurance premium and finding ways to optimize your coverage is a crucial step in managing your finances. By employing the strategies mentioned above, you can strike a balance between cost and protection. Remember, insurance is an investment in your financial security. By making informed decisions, you can ensure you have the right coverage at a manageable price.

Additional Points to Consider

- Government Programs and Subsidies: Some governments offer subsidies or assistance programs to help low-income individuals afford essential insurance coverage.

- Technology and Innovation: The insurance industry is constantly evolving. Insures companies are utilizing technology to offer more personalized pricing and risk assessment methods.

Pingback: A Guide to Comparing Car Insurance Quotes - Loan And Insurance